As an aspiring or current small business owner, not knowing how to raise money for small business can be the biggest obstacle in your way.

You may have tried a few options you know, but you’re still struggling to secure the capital or funding to start or expand your business. Sometimes, this is frustrating, and it can force you to give up. But it’s either the options you have tried are not viable or you’re not going about them the right way.

So, whether you’ve tried any options and failed, or you haven’t even tried any at all, this guide will show you the tested and trusted funding options for your small business. Some of them include:

- Personal savings and assets

- Loans from friends and family

- Business partnership

- Angel investment

- Commercial loans.

At the end of this guide, you’ll know the funding options that are right for your business and how to secure them.

How to raise money for small business in Nigeria

Raising money for your small business, either from your assets or investors, requires a solid business plan. A business plan is a written document that outlines the goals, strategies, and ways you’ll run your business. It also describes how you’ll structure, manage, and fund your business.

Here are 5 reasons you should have a business plan when seeking external funding:

- A business plan provides financial projections to your investors which is a way for them to understand the profit potential of your business.

- With a business plan, investors can understand if your business is a good idea and if it might work out in the long run.

- A business plan points out to investors the growth potential and possible returns of your business.

- You establish yourself as a credible and professional business person before investors with a business plan.

- A business plan helps investors assess the risks of your business and the feasibility of the ways to avoid these risks.

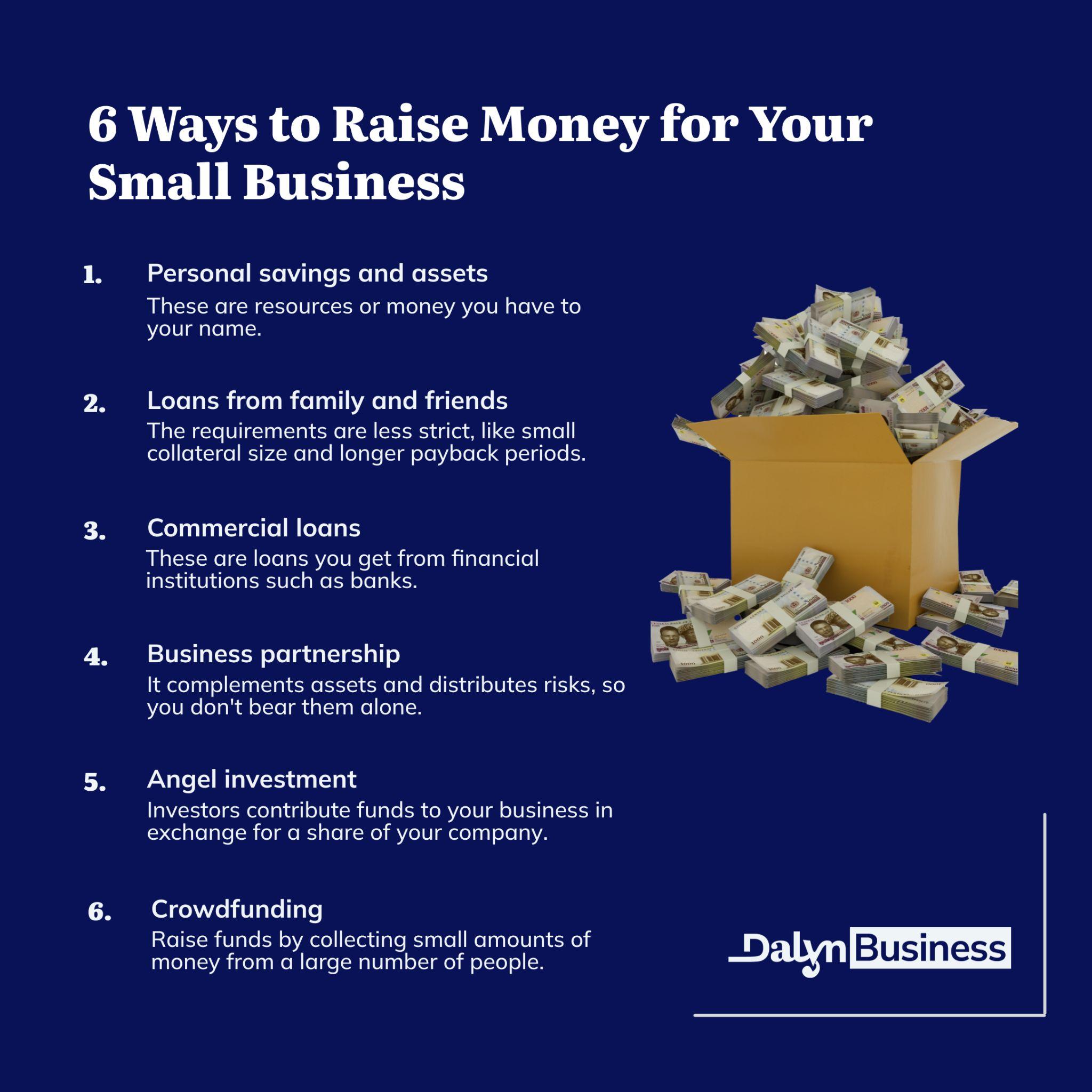

6 ways to raise money for your small business

The following are the ways to raise funds for your business.

1. Personal savings and assets

Personal assets and savings are resources or money you have to your name. While personal savings is the only cash you have in your bank, assets are things you own that can be sold or exchanged for cash. Some examples of personal assets include:

- Landed properties

- Skills

- Expertise.

Let’s assume you want to start a laundry business. These are some advantages of starting with your savings and assets:

- You have total control of your profits. As a dry cleaner, if you make N100,000 monthly, the money is all yours.

- You make decisions faster. You don’t have to call for meetings before deciding since you’re the only investor.

- Starting your business with personal savings and assets eliminates the pressure to pay back investors.

3 ways to acquire personal assets and savings in Nigeria

- Saving a percentage of your monthly earnings as an employee working for someone else

- Investing in learning marketable skills for personal development

- Taking up side jobs to make more money

2. Loans from family and friends

A loan is money you borrow to pay back at an agreed time. Loans from family and friends mostly come as a result of trust.

Here are some reasons why you should consider getting loans from family and friends:

- You pay little or no interest on the loan.

- The requirements are less strict, like small collateral size and longer payback periods.

How to get loans from family and friends

Here are 5 strategies for acquiring loans from family and friends for your business:

- Explain the purpose of the loan and the risks that might be involved.

- Discuss your business plan with them to earn their trust.

- Even after they have given you the loan, update them regularly on the key developments in your business. For instance, if sales increase or drop, let them know.

- Where they don’t ask for any interest, consider offering them one. But only agree to what you can give.

- Create a written agreement with them. It will help give a sense of trust and security between you.

- Consider offering them collateral, especially if you think they’re afraid.

3. Commercial loans

These are loans you get from financial institutions such as banks. They are best for businesses that want to expand because you’ll need to present your business financial statements before getting this loan.

3 reasons to consider commercial loans

- Your business has access to a larger amount of capital.

- You can still have total ownership of your business if that is a priority for you.

- If you go for commercial loans, you can choose a repayment option that best suits your needs. They have varied options.

How to secure commercial loans

The process of getting a commercial loan for your business can be long, but here are some steps you can take to make it easier:

- Visit the bank’s website or go to any of the branches in person.

- Check the requirements to ensure you’re eligible for the loan.

- Sign up or register for an account, if you don’t have one already.

- Fill out the necessary forms.

- Submit the form and all other necessary documents.

- Wait for your loan to be approved.

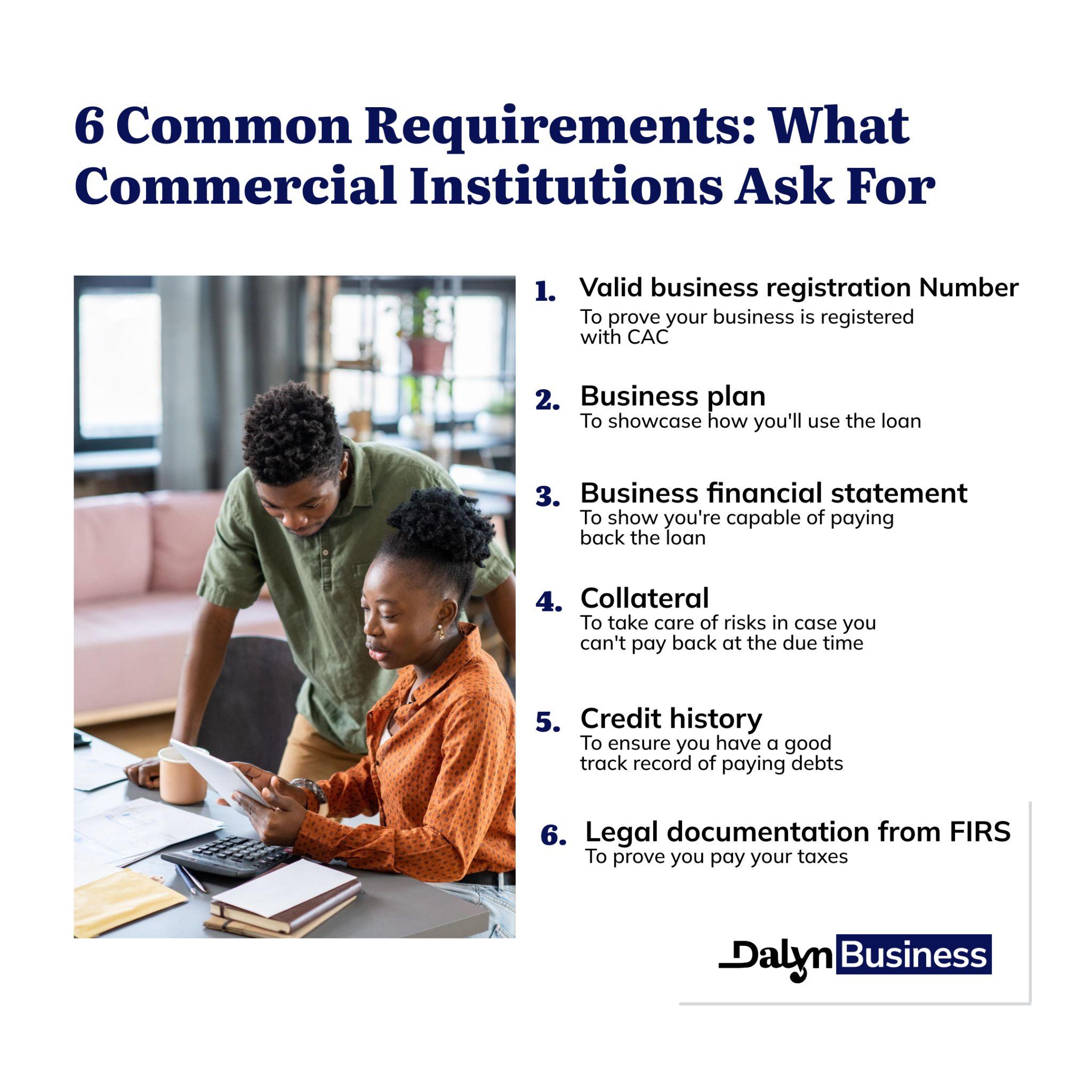

All commercial loans have a list of different criteria that you must meet to be eligible for a loan. Here are 6 common requirements commercial institutions ask for:

- A valid business registration number: You get this number when you register your business with the Corporate Affairs Commission (CAC).

- A business plan: This should detail how you’ll use the loan.

- Your business financial statement: This will show you’re capable of paying back the loan: You can use free software like Zoho Books and Manager to prepare your financial statements.

- Collateral to take care of risks in case you can’t pay back at the due time: Collateral can be a piece of land, houses, or any valuable assets.

- Credit history to ensure you have a good track record of paying debts. You can find out about your credit history from your bank.

- Legal documentation from Federal Inland Revenue Services in Nigeria to show you pay your taxes.

4. Business partnership

In business partnerships, two or more individuals join their financial resources, skills, and expertise to achieve some common business goals. It’s essential to note that these goals would be impossible for them to achieve individually.

For example, if you have the skills or knowledge to start a laundry business, you may not have the funding to start and run it. Therefore, you should partner with someone who has the resources or complementary assets and share the business risks and profits.

Here are 2 major reasons why you should consider going into business partnerships:

- A partnership is a means for your business to have different but complementary assets.

- Partnerships also distribute risks, so you don’t bear them alone.

How to get a business partner

There are several ways to get a business partner:

- Talk to family and friends and ask them to recommend you to people who might want to partner with you.

- Attend events to network and build relationships with your industry professionals.

- Join online platforms like LinkedIn where you can pitch and share your plans with potential partners.

- Jump on partnership opportunities from private or government programmes that offer funding and partnerships such as YouWin Connect, Lions’ Den, etc.

Now that you know how and where to get business partnerships, you have to understand what you need for a partnership to work. They include:

- A business plan to keep you and your partner on track

- Clearly documented roles and responsibilities so that everyone knows what is expected of them

- Trust and mutual respect between you and your partner

- Complementary skills and expertise to ensure every part of your business is covered

- A legal partnership agreement that dictates profits sharing, decision-making, roles, etc

- Goals, values, mission, and vision that align for effective decision-making

- Effective and clear communication between you and your partner to avoid misunderstanding.

5. Angel investment

An angel investment is a funding option for businesses in their early stages. Here, individuals who know the business and have adequate capital invest their funds into your business to get a share of your company.

For instance, Africa’s richest person, Aliko Dangote, is an angel investor if he invests in your laundry business idea.

Here are some reasons why you should consider getting an angel investment:

- Since angel investors are experienced, so they can provide mentorship and help you avoid costly mistakes in your business.

- Angel investors have a strong network of customers and other professionals you might need to connect with.

- Angel investors offer small loans suitable for small businesses.

Here are some ways to secure an angel investment:

- Have a strong business plan that will convince an angel investor to buy into your idea.

- Maximize networking opportunities with angel investors by attending their events, or using social media to interact with them.

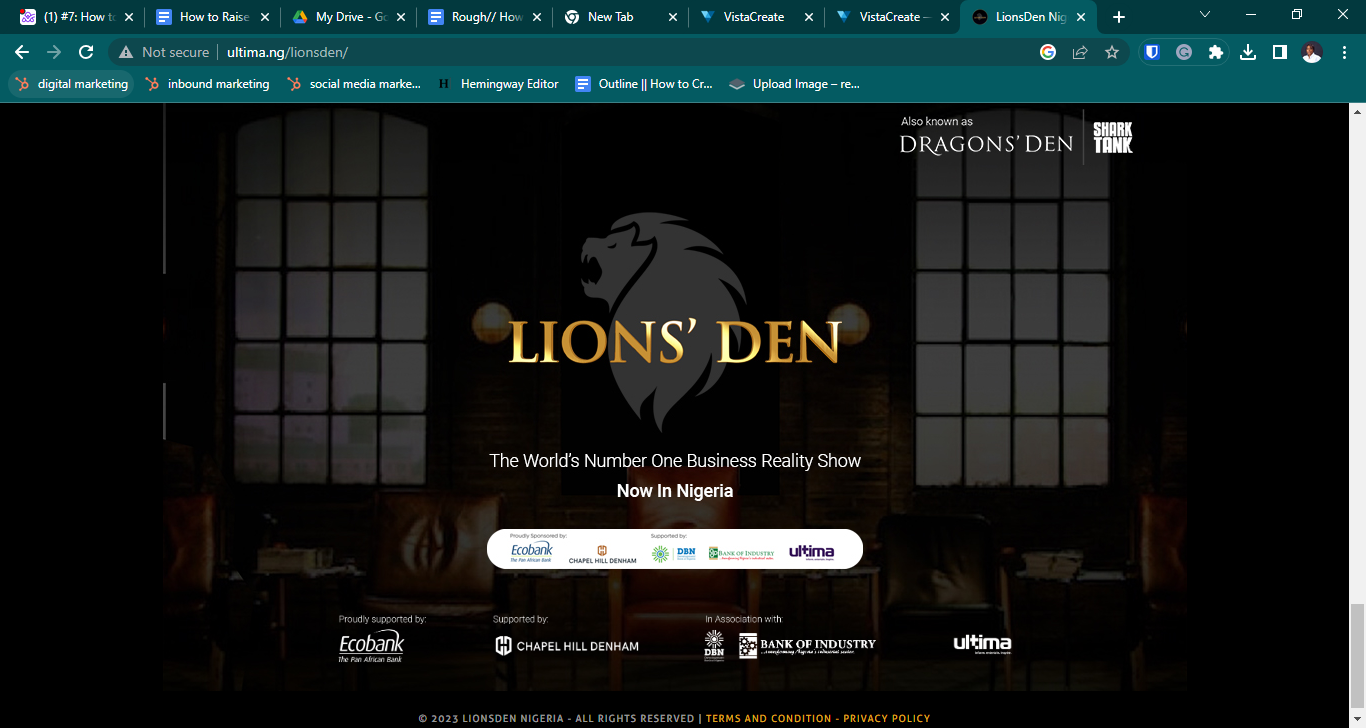

- Enrol for business pitches on TV shows like Dragons’ Den and Lions’ Den which provide opportunities to meet angel investors in person and sell them your idea.

- Join incubator and accelerator programmes like Co-Creation Hub, LeadPath Nigeria, and Wennovation Hub that provide support, resources, and mentorship to help connect you to angel investors.

- State available exit options for angel investors. They’re in it for the money. How do they end the investment and go with their profits? Examples of exit options include buyouts and acquisitions.

Source: Lions’ Den

Tips for pitching angel investors

- Ensure your business is scalable. Angel investors mostly want to invest in scalable businesses which is how they make profits.

- Prepare for scrutiny from angel investors during interviews.

- You should have a team of experienced professionals in your business area.

- Your business valuation (its economic worth) from your pitch has to be realistic.

6. Crowdfunding

Crowdfunding generally means sourcing money from a large number of people. Modern crowdfunding usually happens online on dedicated crowdfunding platforms. But crowdfunding can be done offline too.

Here are reasons why you should consider crowdfunding:

- Crowdfunding is easier to access than angel investment and commercial loans.

- You can define the terms of your offer and rewards which would be almost difficult in other funding options. For example, you can offer an interest of 20%. They either subscribe or go away. In other investing options, you may not even have the opportunity to negotiate.

- Crowdfunding is an opportunity to build a community of supporters around your product or service and gauge the level of interest in your business idea.

How to get crowdfunded

Most business crowdfunding is done over the Internet. To get crowdfunded for your business idea, here’s how to go about it:

- Decide how much you need to start your business.

- Pick a crowdfunding platform. There are many available platforms like NaijaFund and Gofundme.

Source: Naijafund

- Sell your business on the crowdfunding platform with a pitch that states your business mission.

- Clearly state the rewards you’ll offer. If people invest their money in your business, they’ll expect some reward from you.

- Engage in a promotion campaign, using email and social media channels. You should also respond to questions prospective funders ask on the crowdfunding platform.

After you get funded and your business begins to generate profit, give back the reward you promised and make it timely.

How to get grants for your business

A grant is an amount of money an organisation, a foundation, or a government body gives to an individual or a group to support an initiative or a cause. The giver is usually called a grantor.

Grants are sources of business funding that you are not required to pay back. An example is a grant for small businesses in developing countries. The grantor’s initiative here could be to help small business owners create wealth for themselves and their country.

Types of grants

Grants can be classified into:

- Local grants

- International grants

Local grants are issued within a country. An example in Nigeria is the Lagos State Employment Trust Fund (LSETF) for small and medium-sized enterprises.

International grants are available across the world. Examples include the Tony Elumelu Entrepreneurship Programme (TEEP) and the United States African Development Foundation (USADF) grants.

A step-by-step guide to getting grants for your business

The Tony Elumelu Entrepreneurship Programme will serve as an example throughout the following steps.

1. Identify the grant provider

Find out the grant sponsor and instructions on how you can access it. For example, the Tony Elumelu Entrepreneurship Programme (TEEF) is awarded by the Tolu Elumelu Foundation (TEF).

2. Check your eligibility

Before you apply, ensure that you’re qualified for the grant. Eligibility criteria for most grants are usually listed on the website of the awarding institution.

To apply for TEF, for example, you must:

- Be African

- Have a scalable business of not more than 3 years

- Be 18 years of age or older.

3. Prepare an excellent proposal

A grant proposal is your best shot at convincing the institution to award you the grant. It contains your reasons and the plans you want to achieve.

Most funding agencies usually state the components to add while submitting a proposal. But we will briefly list and explain the common components of a proposal in case you come across a grant without such guidelines. They include:

- Cover page: The cover page should contain the title of your business proposal, the name of your business, your contact details, and the date you submitted the proposal.

- Project summary: This is where you give a general summary of your business idea, goals, objectives, and target results. Here you also state the interception of your business idea and the goal of the grantor.

- Table of contents: In this section, you list all the components your proposal covers with their corresponding page numbers.

- Introduction: Here you introduce your business idea, the problem it’s trying to solve, and how it supports your grantor’s cause or initiative.

- Proposed project description: In this section, you go deeper into describing your business idea, its objectives, goals, and how you intend to execute it.

- Needs statement: At this point, you state the issues and challenges your business is trying to solve. Provide facts and data to support your claims.

- Plan of action or methodology: This is where you detail the step-by-step plan for solving the issues and challenges in the need statement section.

- Project budget: A business budget is a specific, measurable, attainable and timely financial goal that details the total cost of starting and running the business until you achieve all the goals you specified in the proposal. Here you detail all the costs and expenses your business will incur.

- Evaluation plan: The evaluation plan is where you state the metrics, tools, indicators, and methods in which to measure your business success.

- Sustainability plan: This highlights all the strategies you hope to use in keeping your business going even beyond the grant period.

- Organisational details: This is where you state the qualifications, experience, and expertise of you and your partners. It’s like your resume section, so you should also mention similar successful businesses you played key roles.

- Conclusion: In this section, you summarize all your main points in the proposal, the relevance of your business idea, and state why the grantor should consider your proposal.

- Additional materials: Here you add other documents that couldn’t fit into any of the other sections. Examples of such documents are resumes of key players in your business, business project timeliness, etc.

4. Gather the required documents

Every grant has a peculiar set of documents required for the application. To give you an idea, here are popular documents for the Tony Elumelu grant:

- A business plan

- Identification documents such as passports, driver’s licenses, or NIN

- Your proof of business registration

- Your business financial statements.

5. Complete and submit your application

After you have provided the necessary documents and filled out the form, cross-check everything to be sure you have not made any mistakes. Only after that should you click the submit button.

6. Follow up on the application

After you’ve applied for grants, be patient. Constantly check your email and the application portal for news and updates.

Finally, if you have questions during and after your application, you can contact the awarding organization through email, social media, or their website. Otherwise, keep working on your business or idea.

How to get government funding for your business

Government funding is an umbrella term for loans, grants, or other forms of financial support a country’s government offers to individuals to run their businesses. An example of government funding in Nigeria is the Bank of Industry (BOI) Intervention.

Source: Bank of Industry

So, why should you go for government funding in Nigeria?

- You can access a large amount of capital from government funding.

- Government funding has low or no interest rates.

- You can get business training and mentorship from government funding.

- Government loans offer longer-term payback options than commercial loans.

A step-by-step guide to getting government funding

1. Identify the government agency

Several government agencies fund small businesses in Nigeria. Pick a specific agency and check out their website. One example is the Small and Medium Enterprises Development Agency of Nigeria (SMEDAN).

2. Access the eligibility of your business

Research the agency’s official website to find out what it takes to get funded.

3. Gather the required documents

There are several documents you need to submit before completing your application for funding. For SMEDAN and a good number of other government funding, here are the documents you need:

- A business plan

- Proof of address

- Certificate of incorporation from CAC

- A cash flow budget for your business

- A valid means of identification such as

- International passport

- National ID card

- Driver’s license

- Voters card

- Details of collateral if you offered any.

4. Complete and submit your application

After you have gathered the documents, fill out the application form and submit everything.

5. Follow up on your application

After your application, be patient. Always check your email and the application portal for news and updates.

You can contact the agency through email, social media, or their websites if you have questions during the process. Otherwise, keep working on your business or idea.

Conclusion

Raising money for starting or expanding your small business is a great achievement. However, before seeking funds, you need to understand the strategies and steps to go about it. Whatever funding options you decide to explore, remember that having a solid business plan is the first step.