Here’s a fact: Pricing can make your business successful or send you out of business. If you price too low, you’ll run your business at a loss and may need to close down faster than you imagined. If you price too high, you may drive away potential customers.

Getting your pricing right can be tricky because you need to find that sweet price that customers are happy to pay and you still make a healthy profit. This is important, particularly in Nigeria, because customers can be extremely sensitive to price changes.

So, whether you’re just starting out or already running a business, you want to come up with the best pricing for your products or services. In this article, I’ll show you how to determine and fix a good price for your products or services. I’ll also show you why giving discounts to customers might work against your business.

At the end of this article, you’ll learn how to price your products and services profitably.

What does pricing mean?

Pricing is a way of determining the cost of your products or services. It involves setting a specific monetary value that customers must pay in exchange for your products or services. Pricing helps you define the financial worth of your products or services.

As a business owner, setting the cost of your products or services should not be random. There should be reasonable grounds for pricing the way you do.

Setting the right price can help your business:

- Make a profit

- Define the worth of your products and services

- Shape customer perception of your product and services.

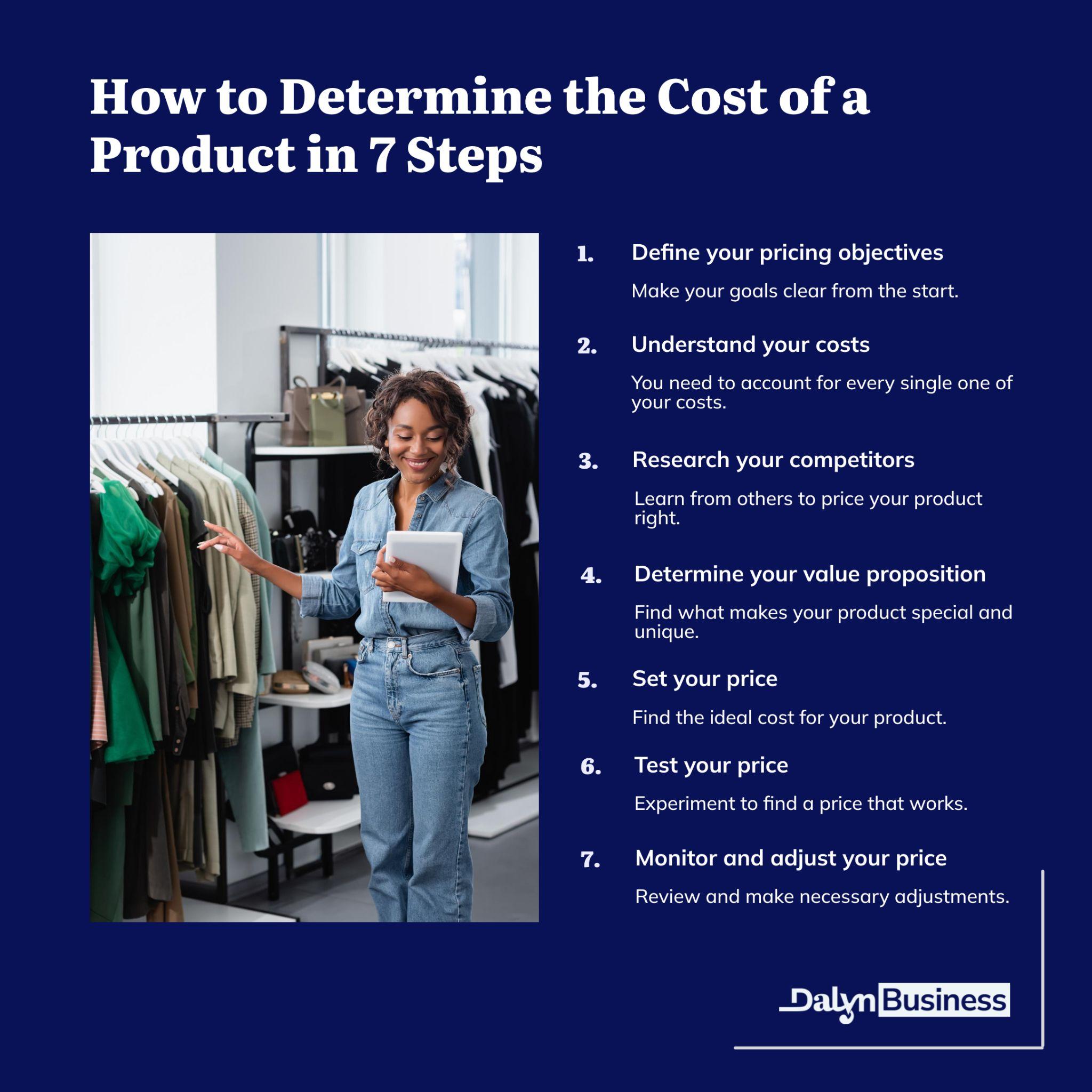

How to price a product step by step

Understanding the steps to pricing your products is essential for your business’s success.

Now, let’s assume you run a bakery that produces different types of baked products. Here are the steps you should follow to price your products.

1. Define your pricing objectives

Before you think of setting the prices for your food, you need to define your pricing objectives.

- Are you new in the business and hoping to attract your first customers?

- If you are new in business and your primary goal is to attract your very first customers, you may want to price your products cheaper than the competition in the beginning.

- If you are already an established bakery, your goal may be to make more profit. Since you are already established, changes in your price may not affect your customer base too much, because you have already established a reputation.

- Is your target to make more sales and profit from the business?

No matter your mission, make it clear at the beginning.

2. Understand your costs

Understanding what it costs you to run your bakery business is a significant step in pricing the right way. Let’s break business costs down to give a better understanding.

Fixed and variable costs are the two types of costs in every business. Fixed costs are your business’s expenses that do not change for a certain duration no matter the quantity of products you make or sell. Your bakery house rent is an example of a fixed cost.

Variable costs are the direct opposite of fixed costs. They are business expenses that change depending on the quantity of products you make or sell over a period. An electricity bill is an example of a variable cost.

You need to account for every single one of your costs. If you identify every place your business spends money, you will be able to factor it into your products and still make a good profit.

3. Research your competitors

Assuming you put your price at an unreasonably high cost, your customers will leave you to buy from your competitors.

Therefore, you need to study your competitors’ pricing strategies. For instance, determine how much they sell a piece of meat pie. Once you find it out, the next step is to balance their price with yours.

4. Determine your value proposition

Determine what makes you unique and attractive to customers.

- Do you have the best customer service?

- Do you deliver quality and delicious baked products?

Hence, it is only clear differences between you and your competitors that should make you price your products more.

5. Set your price

After you have determined your unique selling points (USPs), the next step is to set your price. And you shouldn’t be worried about putting the cost of your product at its worth.

Here’s a super simple way to set the price of your products:

I. Calculate your costs, both direct and indirect costs

Calculate direct costs first because those directly affect the cost of the product.

For example, one production batch of bread may need 1 bag of flour, x sugar, x baking soda, etc. If the total cost of those ingredients is N50,000 and you produce 100 loaves of bread in that batch, then the direct cost of producing one loaf of bread is N500.

II. Calculate indirect costs

These are costs that are not directly tied to production. For example, salaries, diesel, electricity, maintenance, transport, etc. Calculate everything. Then divide it by the number of sales you make in a month.

Let’s say you produce 100 loaves of bread every day in a month. That’s 3,000 loaves of bread in a month. Let’s say your total monthly indirect cost is N300,000. That means it indirectly costs you N100 to produce one loaf of bread.

II. Determine the total cost of producing one loaf of bread

This means you add the direct cost plus the indirect cost. That’s 500+100 = N600. Each bread costs you N600 to produce.

Now you need to set a profit markup percentage. How much profit do you want to make on one loaf of bread? A 20% markup is generally considered healthy for most businesses but you can add more, depending on those factors you’ve covered that affect pricing.

Let’s say you decide to work with a 20% markup. How much would you need to add to the cost price? 20% of 600 is 120. This means you need to add N120 to the final cost. That’s 600 + 120, so the selling price of the bread should be 720. If you sell 3,000 loaves of bread, you will make a profit of N360,000.

Of course, the calculation above is super simplified for illustration purposes, but that’s generally how pricing works.

6. Test your price

Now that you have set your price, examine and consider how your customers react to it. Do this for a specified period, and take note of your sales within that period to know how your prices have affected your customers.

7. Monitor and adjust your price

If your sales dropped after you set the price, or you just had a few sales, you should adjust the price based on the results of your price test. But if sales increased within the period, don’t be tempted to increase your price. You should maintain your price.

Factors to consider before setting the price of a product

Before setting the price for your product, there are essential factors you should consider. Let’s continue with our hypothetical bakery business example.

1. Production costs

Determine how much it costs to come up with a piece of cake. Make sure your pricing covers it with an added profit, too.

2. Competition

You should always remember that you’re not in the business alone. If you set an unreasonable price for your baked products because it’s the most delicious within your business location, you may lose many of your customers to your competitors.

Also, you should often check how your competitors are pricing.

3. Market demand

Is your bakery located strategically? Are there corporate offices around you that demand lunch from you daily? If more and more people want your baked products, they will most likely be willing to pay a higher price.

4. Target market

Your target customers will also influence how you price your product. If you offer tasty, delicious cakes, for example, and your bakery is located where wealthy people often hang out, they will pay more without complaining. So you have to constantly keep your customers in mind when setting the price for your products.

5. Customer perception

You need to understand how customers perceive your product before you modify or determine your price. The best way to do this is to interview customers casually and observe the demand for your products.

6. Marketing and distribution costs

Earlier, we talked about factoring in production in your pricing. You also need to factor in the marketing and distribution costs to have a balanced and profitable business. The price of your products is the only way to make up for these expenditures.

7. Profit margin

You need to have a profit margin in mind, and it should be realistic. Profit margin is the percentage you add to the cost of your product as your profit.

For instance, if it costs N500 to make a piece of meat pie in your bakery business, and you add N100 to cover your profit, your profit margin is 20%. That is, N100 = 20% of N500.

How to price a service step by step

Understanding how to price your service helps you remove all the guesswork from the picture and make maximum profit out of your business.

Assuming you’re a private lesson teacher, here are 8 steps you need to take to determine the cost of your service.

1. Define your pricing objectives

First, you need to define why you’re pricing your service the way you do. Are you planning to increase your revenue, to attract more customers, or to enter a new market?

2. Understand your costs

This is a very important step you need to take. Every business incurs costs. In the case of a private lesson-teaching business, it could be the cost of transportation, teaching materials, etc.

3. Research your competitors

Whether you’re planning to start or are already in your service business, you can research people offering the same service as you do. Your goal is to put things in perspective by finding out how they’re fixing their prices.

4. Determine your value proposition

Something unique about you has to distinguish your service from that of your competitors; otherwise, you’ll get lost in the crowd. As the owner of the private lesson-teaching business, your value proposition could be that you teach special subjects like French and Mathematics.

5. Calculate your costs

For a pure service business, pricing works a bit differently. You still need to calculate your direct and indirect costs.

For example, if you are a website designer, your direct cost may be the cost of buying hosting and a domain name. This should be borne by the customer. If you are a lesson teacher, your direct cost may be transportation.

Indirect costs are everything that you need to deliver that service which the client may not even be aware of. There are two ways to look at it.

If you are a freelancer or work from home and your business is not registered, your indirect costs are your living expenses. That is house rent, feeding, upkeep, etc.

If you are a consultant with a registered business, your indirect costs are your shop rent, salaries, and so on.

Because you are not producing an actual product, you can’t just add direct and indirect costs and set your price. This is a mistake many service providers make. Your time is a cost as well, and you need to account for that.

First, determine how many hours you want to work in a week or month. Then divide your total costs by those number of hours. For example, if your total expenses per month amount to N200,000 and you want to work a maximum of 40 hours in a week, then your hourly rate is N5,000. This means you should be charging at least N5,000 for an hour of your time.

If you want to make a profit, you need to add a markup to that. So, you could add a 50% markup, that’s N2,500. So, your profitable hourly rate becomes N7,500.

Anytime you are quoting the price for a service, you should estimate how much time it will take to deliver that service, then multiply that by your hourly rate. For example, if you offer 3-hour lesson classes every week for a month, that’s 6x3x7,500 = N135,000.

This means you should be charging N135,000 for those monthly private lessons.

Again, this is a super simplified example. Pricing can be far more intricate than this.

6. Set your price

Once you have calculated the pricing for your service, the next step is to officially fix a price for it.

7. Test your price

Before you can confidently say your service now has a price, you need to test it to understand how your customers are reacting to it.

If you’re already in the service business, observe your sales to see for yourself. But if you’re still planning to start the business, you should use a survey to talk to potential customers and know their reactions.

8. Monitor and adjust your price

After you have tested the price, keep monitoring and adjusting it when and where necessary so that your business stays profitable.

Factors to consider before setting the price of a service

For every service you run, there are factors you should consider before setting your price to ensure you make a profit.

1. Costs

There are a variety of costs associated with delivering a service. For a private lesson-teaching business, you’ll factor in costs such as transportation, teaching aids, etc.

2. Value proposition

Consider what differentiates you from your competitors, and determine if the difference is worth affecting your pricing.

3. Competition

Understand who your competitors are and consider their pricing. Examine why they’re pricing the way they’re doing, and if you should adjust your price to theirs or make yours higher.

4. Industry standards

Most industries have standard pricing. Consider your industry standard so that even if you have to go above it, you will have a fair reason for that. Not knowing the industry standard can make you undersell or overprice your services.

5. Customer demand

Determine how badly people need your service. The more people want it, the more you should price it. If more people need your private lesson-teaching service, for instance, you have to hire teachers. You need money to do this.

6. Pricing model

You need to understand the service you provide to know what model to use. Would you price your service on an hourly basis, with fixed charges, per project, or by value-based pricing? The type of service you offer will determine this.

For a food delivery service, you could consider fixed charges. For services like freelance writing, you might consider pricing hourly or per project.

7. Profit margin

Before starting your service-based business, you should have a goal for the amount of money you want to make per period. This goal should be specific and realistic.

8. Brand image

This is how your customers perceive your service. If they think you’re reliable and offer quality service, they will be more willing to pay for it, even when you raise your price.

Key differences between pricing a product and a service

1. Cost of production

Products are tangible and have to be manufactured using raw materials, extensive physical labour, and supervision, while services may not require large-scale physical labour. A product-based business could incur more production costs than a service-based business.

2. Business pricing factors

There are different factors affecting the pricing of products and services.

You may price your product based on the cost of production, raw materials, labour, and market demand, while you price your services based on your level of expertise, time spent on execution, and the way customers perceive your service.

3. Business pricing models

Most products use a cost-plus model. In the cost-plus model, you determine the cost of making your product and then add some price margin to it to serve as your profit.

However, most service businesses use the value-based model where you price based on the value you think your service will create for your customers.

Common pricing strategies to consider for your small business

1. Penetration pricing

In penetration pricing, you offer standard quality products or services at a lower price compared to other established brands. This makes it easier for you to get into the market.

If you’re starting your small business in an already crowded market, you could consider this strategy. However, penetration pricing can affect the level of profit you can make and how customers perceive your products or services. It can cause competitors to lower their prices which might make your strategy counterproductive.

2. Premium pricing

This strategy entails that you set your prices above your competitors’ prices, believing that high-valued customers will buy from you. To use the premium pricing strategy, you have to ensure that your business offers quality products and services.

Let’s consider premium pricing in a fast-food business. If you package your Indomie noodles in a branded container and add extra vegetable toppings as against your competitors who do not do these, some customers may be willing to pay even when you raise the price.

Premium pricing can guarantee increased profit and revenue for your business. It can also make customers perceive your products and service as more valuable. However, the downside is that competitors can create the same or higher quality products or services and sell them cheaper, making your business lose out on a huge number of customers.

3. Competition-based pricing

In competition-based pricing, the pricing of your competitors is your yardstick for setting your prices. Therefore, you have to research your competitors to know how they’re pricing and then put your price around their range.

If you’re not doing pricing the right way, but already have a strong market presence, this strategy might help you increase your sales. But if you’re just starting, with no market presence yet, this will be a very competitive strategy to consider.

4. Value-based pricing

This is a pricing strategy where you base the price of your product or service on the value it will generate for your customers.

If you deliver lunch to office workers, you’re saving them the time they could have spent looking for lunch. So, instead of focusing solely on the cost of delivering the lunch to them, it makes sense to charge for your service from this point of view.

However, to implement this kind of pricing strategy, you must have a unique value proposition that differentiates you from your competitors. Also, you need to understand your customers, their needs, and their capacity to pay your price.

5. Cost-based pricing

Cost-based pricing is a strategy that considers the cost of production, raw materials, labour, and other costs for making a product or creating and delivering a service.

In addition to the cost, a profit margin is added for your business to make a profit. For example, as a fast-food business owner, if it costs you N1,000 to prepare a plate of Indomie noodles and eggs, you can decide to add a profit margin of 20% to it. This puts the selling price of your plate of noodles at N1,200.

Cost-based pricing is one of the most popular pricing strategies used in Nigeria, and it works for a lot of small businesses.

Offering discounts to customers: How to do it the right way

Offering discounts is a way of attracting customers, but it can increase or decrease your sales. Using it the wrong way may lower the perceived value of your product or service.

If your customers start to view your product as cheap, they may conclude that its quality is low, and this will negatively affect your sales. Therefore, it is essential to offer discounts the right way.

Let’s examine the best practices you should consider when offering discounts to your customers.

Best practices for discount pricing

- Have a clearly defined objective for your discount. Do you want to make more sales or to attract new customers?

- Understand the overall cost of your products and services to know if discounts will affect your profit greatly.

- Define your discount parameters. These include the duration of the discount, how to qualify for discounts, and the percentage of discount offers.

- Your discounts shouldn’t be open to all customers. Focus on a specific segment of your audience.

- Consider special events and occasions. Jumia, for instance, offers discounts for Black Friday sales.

- You should consider bundling up two or more of your products or services and attaching a discount, instead of giving a straight discount on a single product or service.

- Find creative ways to make your audience aware of your discount; for example, social media announcements.

- Continuously monitor, evaluate, and adjust your discount prices.

Important pricing terms to remember

1. Cost price

This is the amount of money it takes you to create a product or service.

To prepare a plate of Indomie noodles in our fast-food business example, you’ll need eggs, about 2 sachets of Indomie noodles, water, etc. The total cost of these individual items gives you the cost price of a plate of noodles.

2. Fixed costs

Fixed costs, also called overhead costs, are costs that do not change over a particular period even with the level of production or sales volume. Fixed costs include:

- Your business office rent

- Taxes

- Service subscriptions.

3. Selling price

The selling price is the amount of money customers pay for your product or service. It should cover the cost of creating the product or service and an additional amount as profit.

If you deliver a package of food using your food delivery service at N1,000, that is your selling price.

4. Profit margin

This measures the amount of profit you make in your business in percentage after you remove all the expenses from your total revenue.

Mathematically, profit margin = (Net profit/Revenue) X 100.

Assuming you make a yearly revenue of N1,000,000 from the fast-food business and spend N500,000, your profit margin is 50%.

Note that Net profit = Revenue – Expenses = N500,000.

5. Variable costs

Variable costs are costs that change with the level of production and sales volume over a time interval. Possible variable costs in your business can include:

- The cost of labour

- The cost of raw materials

- The cost of transportation.

6. Price elasticity of demand

This is a measure of the change in demand for your product or service due to a price change.

Therefore, if you change the price of a plate of Indomie noodles in our fast-food business, how does it affect the number of plates you sell? Do sales drop, increase, or remain the same as before the price change?

Conclusion

As a business owner, pricing is one aspect of your business that should be intentional and well-planned. If your pricing falls short of any of the strategies pointed out in this article, you may not achieve the sales goals you have set for your business. And this will either cost you potential customers or affect the profits you make.

Pricing your products and services isn’t something you do arbitrarily. Once you consider the steps and factors discussed in this article, you’ll price your products and services better, bring in more customers, and maximize profits.